30+ what is a trust deed mortgage

A trust deed is a type of agreement securing a real estate loan thats made between a lender and borrower to have the main property held in a trust by an independent and neutral third party until the loan is paid off. Search Valuable Data On Properties Such As Deeds Taxes Comps Pre-Foreclosures More.

California Real Estate Principles 10 1 Edition Ppt Download

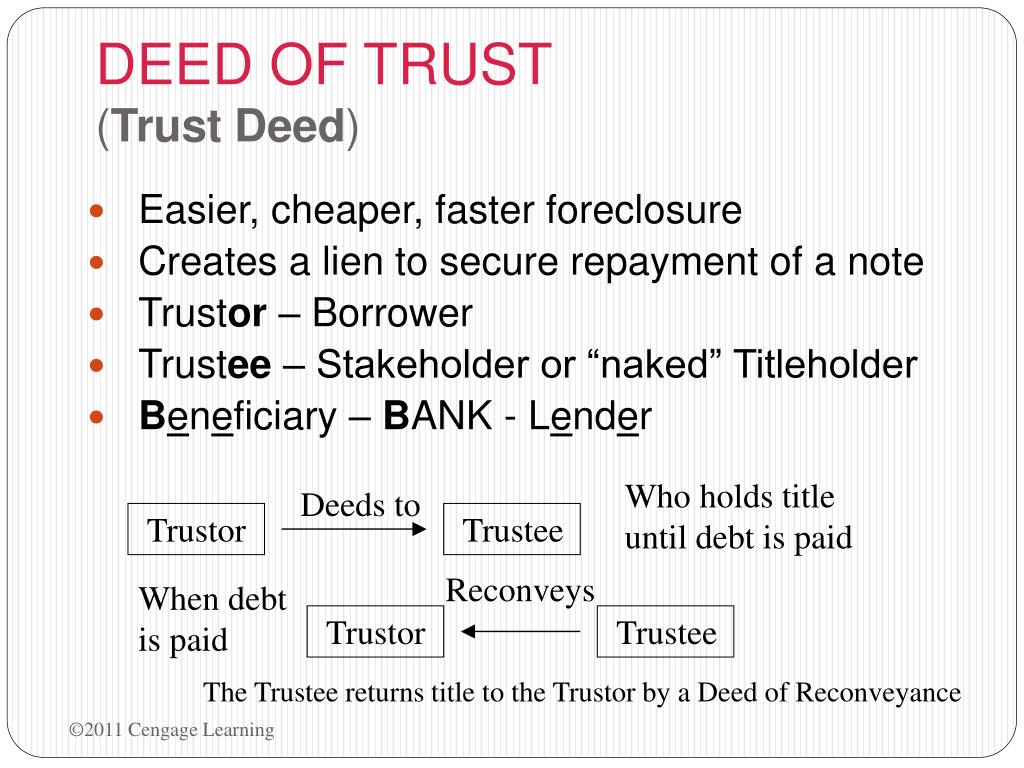

Web A deed of trust is a contractual agreement between three partiesthe borrower the lender and a trustee.

. The lender gives the borrower money. It provides the parties involved with loan interest in the property and the legal rights the lender has over the property. A lender a borrower and a trustee.

Web A trust deed is a legal agreement between a lender and borrower for a loan. A mortgage is a loan while a deed of trust is not. Web A deed of trust is a method of securing a real estate transaction that includes three parties.

In exchange for completely paying off. Web A deed of trust involves three parties. Unsure Of The Value Of Your Property.

HOLMES ISB 4525 HOLMES LAW OFFICE PA. If the borrower fails to repay the money as agreed the lender then becomes the owner of the property. This article will explain what a deed of trust is how it works and how the foreclosure process works if you have a deed of trust versus a mortgage.

In the event of foreclosure with a mortgage deed the lender often goes through litigation in order to foreclose on the home if the homebuyer defaults on their loan. Both have a different number of parties involved. In this agreement the lender transfers the title of the borrowers property to an escrow company acting as a trustee.

Web The average rate for a 30-year fixed-rate mortgage currently sits at 666 up from 440 when the Fed started raising rates last March. Web The trustee a neutral third party often a title company In a deed of trust as with a mortgage the borrower makes monthly loan payments to the lender. A mortgage has a judicial foreclosure and a deed of trust has a nonjudicial foreclosure.

As security for the promissory notes the borrower transfers a real property interest to a third-party trustee. A lender and a borrower. The trustee is an independent third party like a title company trustee company or bank.

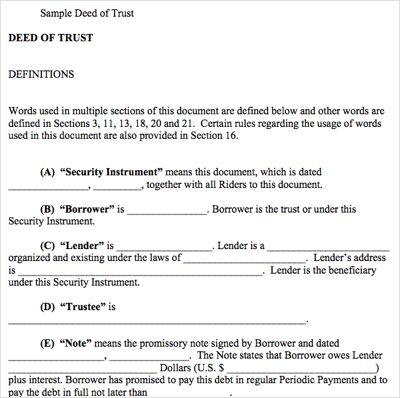

A beneficiary lender a trustor borrower and a neutral third party known as the trustee usually a title or escrow company. Browse Our Wide Selection of Easy Do-It-Yourself Legal Forms and Contracts. Ad Make Your Mortgage Deed Form Using Our Clear Step-By-Step Process.

Also deeds of trust are only available in some states. Search Any Address 2. The lender gives the borrower the money to buy the home in exchange for one or more promissory notes while the trustee holds the legal title to the property until the loan is paid off.

The trustor the borrower the lender sometimes called a beneficiary and. Web A deed of trust is a way for a third party the trustee to hold an interest in the property while another person a borrower performs a promise they have made to someone else the lender. A deed of trust has a borrower lender and a trustee.

HOLMES Successor Trustee To KOOTENAI COUNTY TITLE COMPANY LISA A. Find All The Record Information You Need Here. Web Generally a mortgage deed is a legally binding instrument or loan document that stipulates the mortgages terms and conditions using the property as collateral for a loan.

See Property Records Deeds Owner Info More. In exchange the borrower gives the lender one or more promissory notes. A mortgage has two parties.

Web First a trust deed is different from a mortgage in the number of parties involved in the contract. Ad Legally Binding Mortgage Deed Trust Template in 5-10 Minutes. In the context of deeds of trust the borrower is the homebuyer who promises to pay the loan amount to the lender.

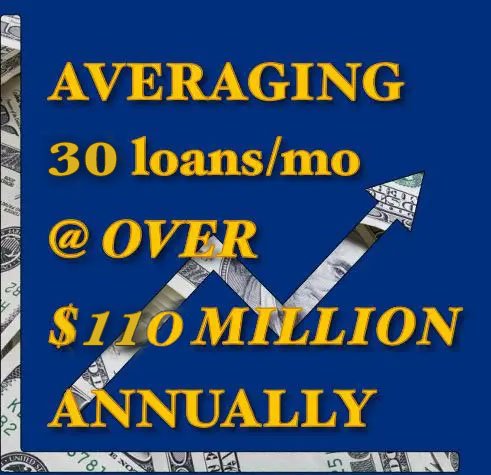

Deeds of trust are usually faster and cheaper for the lender. Web What is Trust Deed Investing. Answer Simple Questions To Create Your Legal Documents.

The trustee holds bare or legal title to the property. Web Up to 25 cash back Again while a mortgage involves two parties a deed of trust involves three. Web The number of parties involved between both types of contracts also differs.

The trustee is a neutral third party that holds the title to a property until the loan is completely paid off. A lender borrower and an independent third-party trustee. Web A Mortgage Deed also known as a Mortgage Agreement is a document where a borrower of money grants the lender of that money conditional ownership in a property as a security interest against the loan until the loan is paid in full.

Usually the trust deed involves three parties. The lender the borrower and the third party acting as trustee. Web 20 minutes agoDated this February 15 2023 SLISA A.

A trust deed has three parties. The borrower and the lender. Web The five main differences between a deed of trust and a mortgage are.

A mortgage involves just two parties. Ad Find County Online Property Records Info From 2022. IRONWOOD DRIVE SUITE 301 COEUR DALENE.

However the trustee holds the title. Web A mortgage and a deed of trust are both legal documents that create a lien on the real property but they are structured differently. A For Sale sign outside of a home in Atlanta.

Trust Deed Investment Loans In California Private Money Lender Sun Pacific Mortgage Real Estate Hard Money Loans In California

What Is A Deed Of Trust Lendingtree

Blog Excel Tdi

What Is A Deed Of Trust Definition And How It Works Rocket Lawyer

How To Be A Silent Co Investor On A Residential Property Without Being On Title Yet Still Having Security Against And Full Legal Claim To My Share Of The Asset Quora

What Is The Difference Between A Mortgage And A Trust Deed Talkov Law

Ppt California Real Estate Principles Powerpoint Presentation Free Download Id 1416006

Fidelity Mortgage Lenders Inc Fidelitylenders Twitter

Juriste International 2002 2 By Uia Juriste International Issuu

Deed Of Trust Explained What You Need To Know Trust Will

Deed Of Trust A Definition Rocket Mortgage

Free 9 Sample Deed Of Trust Form In Pdf Ms Word

Trust Distribution Resolutions Lodge By 30th June To Avoid 47 Tax Walsh Accountants Gold Coast Accountants

Protecting Yourself And Heirs From Inheritance Theft

Free 9 Sample Deed Of Trust Form In Pdf Ms Word

What Is A Deed Of Trust Homebuying Guide Smartasset

Trust Deed Investment Loans In California Private Money Lender Sun Pacific Mortgage Real Estate Hard Money Loans In California